Significant legal changes were enacted in the late 1990s which encouraged the historic housing bubble which began in 1996 and burst in early 2007. One of these laws was the Gramm-Leach-Bliley Act (G-L-B Act) which reversed the Banking Act of 1933, better known as the Glass - Stegall Act (G-S Act). These major changes and their repercussions are explained in terms of the SAMVA USA chart (Perpetual Union). Importantly, the financial crisis of 2007 - 2008 was accurately predicted before the event based on this chart as well as the sluggish economic recovery since.

Significant legal changes were enacted in the late 1990s which encouraged the historic housing bubble which began in 1996 and burst in early 2007. One of these laws was the Gramm-Leach-Bliley Act (G-L-B Act) which reversed the Banking Act of 1933, better known as the Glass - Stegall Act (G-S Act). These major changes and their repercussions are explained in terms of the SAMVA USA chart (Perpetual Union). Importantly, the financial crisis of 2007 - 2008 was accurately predicted before the event based on this chart as well as the sluggish economic recovery since.Opening the gates

The G-S Act was enacted in the wake of the collapse of banking in the Great Depression of the 1930s.[1] It established the Federal Deposit Insurance Corporation (FDIC) in the United States and introduced banking reforms designed to control speculation. The G-L-B Act removed the restrictions of the G-S Act and thereby opened the doors for the biggest speculative boom in US financial history. It has also been alleged that the G-L-B Act transferred effective control over the entire US financial services industry (including insurance companies, pension funds, securities companies, etc.) to a handful of financial conglomerates and their associated hedge funds.[2]

On November 12, 1999, President William Jefferson Clinton signed the G-L-B Act into law with the following words:

“Today I am pleased to sign into law S. 900, the Gramm-Leach-Bliley Act. This historic legislation will modernize our financial services laws, stimulating greater innovation and competition in the financial services industry. America's consumers, our communities, and the economy will reap the benefits of this Act.“[3]In short, while the aims were good, the legislation did not anticipate the inherent weakness for speculation in the housing market and the resulting crash and pain to US citizens that was to follow. Other legislative changes having a similar influence, involving e.g. housing mortgage giants Fannie Mae and Freddy Mac, were soon to follow. With growing knowledge of the elements of the crisis, the divine astrology of the Vedas and the new horoscope for the USA, it becomes possible to identify and warn against such developments in the future.

Astrology of the event

At the time of signing, the Venus-Sun period was operating in the SAMVA USA chart. Sun periods are normally associated with progress in US national life. The Sun, along with Jupiter, is a general indicator of banking. The Venus major period is associated with indications of the 4th and 6th houses, notably financial stability problems linked to housing. Transit 2nd lord Sun was debilitated and in old age in the 4th house of housing at the time of signing. Transit Rahu and Ketu at 12° 54‘ Cancer and Capricorn were afflicting natal Mercury as 3rd lord of enterprise and freedom of action at 12° 05‘ Capricorn and 7th house as well as Rahu aspecting natal Mars as 10th lord of laws in the 5th house of speculation. Transit Mercury at 3° 29‘ Scorpio was conjunct natal Jupiter as 6th lord of financial stability in the 5th house of speculation. Transit Saturn as 8th lord of obstacles and endings was debilitated at 19° 20 Aries and thus conjunct the MEP of the 10th house as well as Rahu at 17° 47‘ Aries. Transit 6th lord Jupiter was at 3° 29‘ Aries in the 10th house of laws. Transit 4th lord Venus was debilitated at 10° 11‘ Virgo and 3rd house.

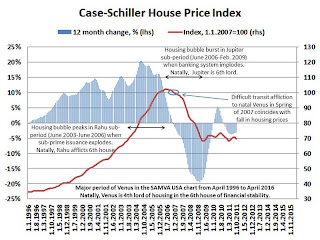

As has been mentioned in earlier articles on this blog, the repercussions of the bursting of the housing bubble in the USA in 2007 have been serious. Moreover, the housing market is expected to remain rather weak during coming years, or until the Venus major period ends in April 2016, hampering the recovery of the economy. However, other factors are expected to turn positive in the forthcoming sub-period of Mercury from April 2012, linked to new enterprises and high tech/IT production.

Venus and housing

It has been repeatedly discussed on this blog how the the Venus major period in the SAMVA USA chart brought problems in the area of housing.

"As Venus is badly placed and weak in the 6th house of the chart, the acquisition of homes or vehicles is based on debt and this can become a source of conflict or problems, such as in mortgage debt defaults."[4]

Indeed, a housing bubble of unprecedented proportion developed in the USA during the Venus major period (April 1996 - April 2016) as seen in the accompanying graph by Schiller. The graph shows that housing values began to skyrocket as this major period began.

It has also been shown how during the Rahu sub-period (2003-2005) the toxic sub-prime debt was generated and sold around the globe. This was the catalyst of the financial problems once housing prices began to decline. A graph of the sub-prime issuance is shown in the article The US-led global financial crisis.[5]

Jupiter and banking

The serious banking problems erupted in the USA during the Jupiter sub-period (June 19, 2007-February 17, 2009) within the Venus major period (April 1996-April 2016).

The following graph shows clearly how it was in the Jupiter sub-period that the banking crisis broke out and US financial stability was harmed by the housing bubble bursting. Public finances were also harmed when the government increased its debt in protecting the banking system even if many banks went bust. In the Saturn sub-period (2009 - 2012) the focus has shifted to a sluggish recovery and unemployment.

One feature of the US financial crisis was the massive failure of banks stemming from the systemic failure in the housing loans.[4]

2006: 0

2007: 3

2008: 30

2009: 148

2010: 157

2011: 92

In most cases the failure took the form of "Purchase and Assumption". This is where the insured and uninsured deposits, certain other liabilities and a portion of the assets were sold to an acquirer.

One of the largest US banks, Bank of America, is now in trouble and may sell of assets to maintain a sufficient amount of reserves to be deemed "healthy" enough by the regulators to withstand temporary funding stress.[5]

The link between Jupiter and banking is clear in the SAMVA USA chart: Jupiter is 6th lord of financial stability. It is located in the 5th house of speculation. Jupiter is also the general indicator (along with the Sun) of banks. Finally, Rahu, indicator of manipulation, is in the MEP of the 10th house of laws, where it affects the 6th house of financial stability. In 1999, US legislators weakened the laws governing the banks, enabling the banks to become highly speculative, veritable casinos, thus setting them up for a crisis. Venus as 4th lord of fixed assets (housing) is placed in the 6th house. The banking problems are directly linked to the bursting of the house price bubble in early 2007.

Banks began to experience funding problems in July 2007, when news of losses linked to sub-prime mortgages began appearing and a German bank, which had invested heavily in these US housing market instruments, failed. In August 2007 an international liquidity squeeze emerged on the inter-bank funding market, with the US Federal Reserve and other central banks stepping in with emergency cash. In March 2008 the problems became so great that Bear Sterns bank failed and was taken over by J.P. Morgan. Other gigantic such failures occured in September 2008, including AIG, Fannie Mae and Freddy Mac, which had to be rescued. Inter-bank lending completely froze up on September 15, 2008, after Lehman Brothers collapsed. Since the massive crisis of that time, there have been ongoing after-effects, with bank failures, even after the Jupiter period ended.

This has been linked to transit afflictions involving either transit or natal Jupiter This is the case at present, with transit 8th lord Saturn afflicting transit Jupiter and transit stationary Rahu afflicting the 5th house, where Jupiter is natally placed. The fact that Rahu natally afflicts the 6th house, owned by Jupiter, is important in this respect. In particular, we can note the regular 20 year cycle of Saturn-Jupiter oppositions has been ongoing from early 2010 to early 2012 (exact on May 23 and August 16, 2010). This is consistent with the banking failures have been so great in 2010 and 2011, as the above table demonstrates. Despite that, the system remained functioning in these years, as sluggish economic growth emerged in the Saturn sub-period (February 2009-April 2012).

Conclusion

We know that the transit and period influences in the SAMVA USA chart allowed us to predict such problems. With the clarity of hindsight a more precise explanation has emerged concerning the elements of the crisis and their interaction. The associated astrological knowledge has value in warning about such weaknesses in the future.

References

[1] Chossudovsky, Michel (2008). "Global Financial Meltdown: Sweeping Deregulation of the US Banking System." Global Research, October 17. http://www.globalresearch.ca/PrintArticle.php?articleId=10588

[2] Glass-Stegall Act on Wikipedia.

[3] “Statement on Signing the Gramm-Leach-Bliley Act.“ The American Presidency Project. November 12, 1999.

http://www.presidency.ucsb.edu/ws/index.php?pid=56922#axzz1jWbWPgjV& McLaughlin, Martin (1999).“Clinton, Republicans agree to deregulation of US financial system.“ November 1, WSWS.org

[4] Cosmologer. "The year ahead for the USA." December 31, 2007.

[5] Cosmologer. The US-led global financial crisis. November 15, 2008.

http://cosmologer.blogspot.com/2008/11/us-led-global-financial-crisis.html

[6] FDIC Bank failures in the United States. FDIC.gov

http://www2.fdic.gov/hsob/HSOBSummaryRpt.asp?BegYear=2011&EndYear=2006&State=1&Header=0

[7] Reuters. "BofA told Fed it could sell branches in emergency: source." Jan 13, 2012 6:30pm EST.